FCC’s net profit rises 9.2% in the first half of the year

- Turnover amounted to €4,237.5 million, up 8.7% on the same period of the previous year

- Gross operating income (Ebitda) increased by 4% to €608.4 million

FCC posted an attributable net result of €279.6 million in the first half of the year, up 9.2% on the same period of 2023.

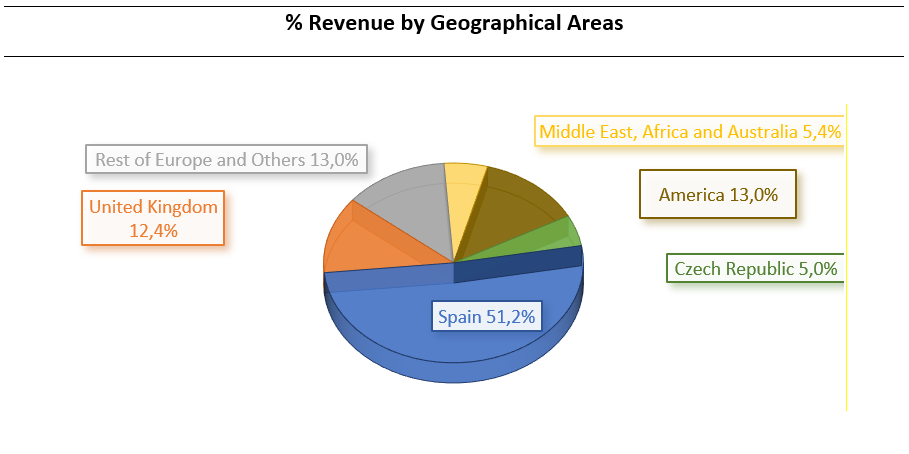

In the first half of the year, revenues grew by 8.7% compared to the previous year, to reach €4,237.5 million, carried by a strong operating performance across all the FCC Group’s business areas, which have been strengthened by new contract awards as well as by acquisitions.

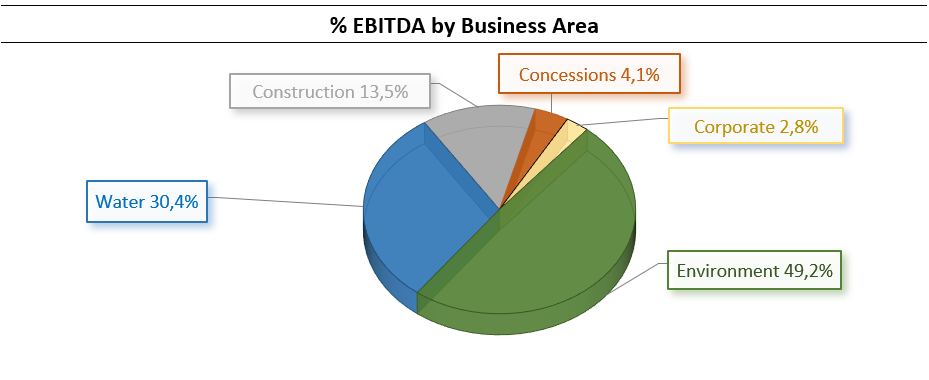

Meanwhile, the FCC Group’s gross operating profit (Ebitda) stood at €608.4 million, up 4% on June of the previous year. The Ebitda operating margin was 14.4%.

Net operating profit (Ebit) amounted to €355.1 million in the first half of the year, versus €324.4 million in the same period of 2023 (+9.5%).

Net financial debt was down 3.9% to €2,978.7 million on 30 June 2024. This reduction is largely due to higher payments on investments and acquisitions at the Environment and Water areas, offset by the exclusion of financial debt from the spun off segments.

Equity climbed 4.9% to reach €6,442.6 million.

| KEY FIGURES | |||

| (million euros) | Jun. 24 | Jun. 23 | Chg. (%) |

| Revenue | 4,237.5 | 3,897.5 | 8.7% |

| Gross operating profit (EBITDA) | 608.4 | 584.9 | 4.0% |

| EBITDA Margin | 14.4% | 15.0% | -0.6 p.p |

| Net operating profit (EBIT) | 355.1 | 324.4 | 9.5% |

| EBIT margin | 8.4% | 8.3% | 0.1 p.p |

| Inconme attributable to the parent company | 279.6 | 256.0 | 9.2% |

| Jun. 24 | Dec. 23 | Chg. (%) | |

| Equity | 6,442.6 | 6,145.9 | 4.9% |

| Net financial debt | 2,978.7 | 3,100.1 | -3.9% |

| Backlog | 43,139.5 | 41,485.0 | 4,0% |

Important milestones

FCC Environment strengthens its presence in the United States, France and Spain

In late May, the subsidiary of the environmental area operating in the United States (FCC Environmental Services) acquired Gel Recycling Holdings, one of the largest recyclable materials management companies in Central Florida. The acquisition also includes the addition of three construction and demolition debris recycling facilities. In June, an exclusive agreement was reached to weigh up the merits of acquiring the operating subsidiaries of Europe Services Groupe (ESG) in France, which reported revenues of €98.7 million in 2023. The deal is subject to obtaining various necessary authorisations and meeting several customary conditions precedents, so it is estimated that the transaction will be completed in the third quarter of 2024. Meanwhile, the purchase of the Urbaser group’s business in the United Kingdom, as agreed in December 2023, was completed in the second quarter of 2024. The enterprise value (including debt and equity) amounted to £398 million. The acquired business consists mainly of recycling and waste treatment activities.

New contracts awarded in the second quarter included projects in Spain and the United States. In Spain, highlights included:

- The management of the Badajoz municipal solid waste (MSW) treatment plant (composting and recovery) for 15 years and an associated backlog amounting to €94.5 million.

- The award, under a joint venture (JV), of the new waste collection and street cleaning contract for the coming 10 years by Palencia City Council. The contract represents a portfolio of around €74 million.

- New contract for waste collection, street cleaning and management of clean points in the city of Benalmádena, for a total of €82 million over the next 10 years.

Meanwhile, key projects in the United States in the first half of the year included:

- The award in Clay County (Florida) of the MSW collection service for a term of 10 years, plus two possible further extensions of five years each. The total amount of the awarded portfolio, including extensions, amounts to $421 million.

- In March, Sarasota County (Florida) awarded a new contract worth $750 million for MSW collection in the southern side of the county. The service has an initial term of seven years, with two possible further extensions of seven and six years, and will commence in the first quarter of 2025.

- In May, in Saint Paul, Minnesota’s capital city, an MSW contract worth more than $115 million was awarded. It will have a duration of seven years, running from 1 November 2024.

- In Buncombe County (North Carolina), an MSW collection contract worth more than €100 million was secured. With an initial term of seven years and a further extension of one year possible, it will run from 1 January 2025.

- These contracts, together with the one previously awarded in Florida (St Johns, in late 2023), will increase the population served in Florida by a further 780,000 people, in Minnesota by 300,000 and in North Carolina by a further 175,000. They will also increase the population served globally by the Environment area to close to 71 million people. In several cases, the services will be provided by new vehicles that run on compressed natural gas (CNG), as well as other fully electric vehicles, thus demonstrating FCC’s commitment to sustainability and the urban environment.

FCC Aqualia expands its international activity and seals its entry into the US market

Last December FCC Aqualia entered the US market with the purchase of MDS (Municipal District Services), a company based in Texas, for 81.9 million euros. MDS manages the comprehensive water cycle of more than 360,000 local residents, mostly in the outskirts of Houston, with nearly 140 service contracts in place with different district clients.

With regard to the contracts awarded in the first half of the year, the consortium in which Aqualia takes part was awarded the contract for the operation, maintenance and repair of the three desalination plants in Ibiza (Spain) over the next four years, which can be extended for a further year. The contract is worth a total of €14.2 million.

FCC Construcción secures the Oporto Metro contract (Portugal) and the underground construction of line R2 in Montcada i Reixac (Barcelona)

The consortium headed up by FCC Construcción (60%) was chosen to build the new Oporto metro line, known as Rubi (H), for an attributable amount of €227.7 million. The new line will add 6.3 kilometres to the city’s existing metro network. Furthermore, the joint venture in Spain in which FCC Construction holds an interest was awarded the contract for the underground construction of line R2 in Montcada i Reixac (Barcelona), as well as the construction of the new station in this town, for an attributable amount of €148.9 million.

In June, the FCC AGM approved the partial financial spin-off of FCC to Inmocemento

On 16 May 2024, the Board of Directors of FCC S.A. announced the proposed partial financial spin-off of FCC, whereby it will transfer en bloc the Real Estate and Cement business units to Inmocemento (a company wholly owned by FCC), without this entailing any extinction of the existing companies or units. More precisely, all the shares of FCYC, S.A. owned by FCC, representing 80.03% of its share capital, and all the shares of Cementos Portland Valderrivas, S.A. owned by FCC, representing 99.028% of its share capital, will be transferred. As a result, Inmocemento will acquire, by universal succession, all the assets, liabilities, rights, obligations and other items inherent to the spun-off assets.