FCC Group increases its EBITDA by 11.7% in 2024, to 1,435.3 million euros

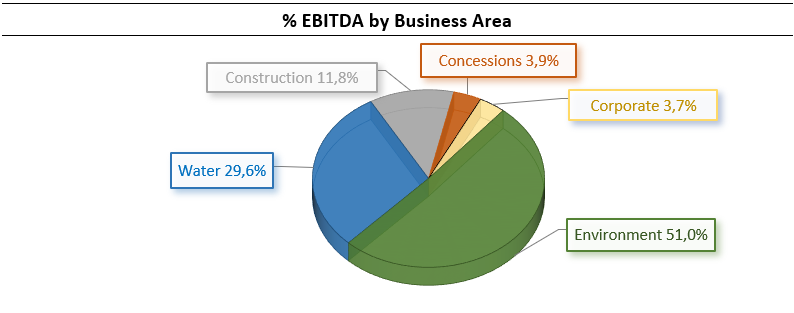

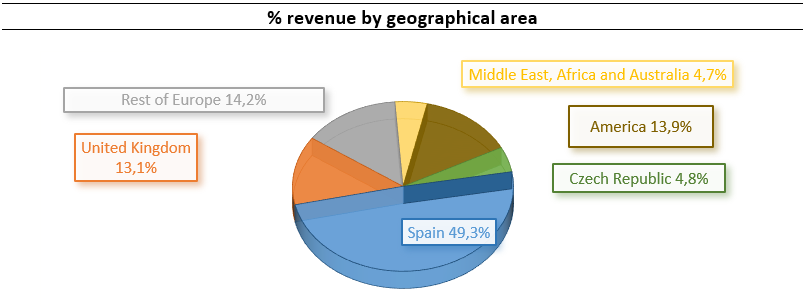

Madrid, 26 February 2025. One of the highlights of the 2024 annual results presented by the FCC Group was its turnover in the period, which amounted to 9,071.4 million euros, 10.4% higher than in the previous year. This growth was mainly caused by increased activity across all of the FCC Group's business areas, particularly Concessions, with excellent growth of 26.3%, followed by the Environment and Water businesses, which increased by 12.8% and 12.6%, respectively, mainly due to new contracts and acquisitions in Europe and the USA.

Gross operating profit (EBITDA) was 1,435.3 million euros at year-end 2024, an increase of 11.7% compared to the previous year. This was due to increased revenues and stability in its operating margins, to which the Concessions area made a significant contribution. The operating margin was 15.8% of turnover.

The Cement and Real Estate business areas were spun off and excluded from the FCC Group from November 2024, contributing to a 27% decrease in attributable net income, to 429.9 million euros at the end of the year.

Consolidated net financial debt was 2,990.4 million euros at 31 December, down 3.5% compared to December 2023, mainly due to increased payments made for investments by the Environment and Water areas and exclusion of the financial debt of the businesses spun off from the Group.

Equity stood at 3,736 million euros, a 39.2% reduction compared to December 2023, largely due to the partial financial spin-off of FCC to Inmocemento, which involved the transfer of all the net assets of the Real Estate and Cement business areas to FCC shareholders last November.

The FCC Group's backlog at 31 December 2024 was up by 3.8%, at 43,043.8 million euros.

Milestones for the financial year 2024

FCC Environment strengthens its presence in the United States and Europe

As regards corporate operations performed during the year, FCC Environmental Services, the subsidiary of the environmental area operating in the United States, acquired Gel Recycling Holdings in May, one of the largest management companies for recyclable materials in central Florida. The acquisition also includes the addition of three construction and demolition debris recycling facilities. In June, the acquisition of the Urbaser Group's business in the United Kingdom, which consists mainly of recycling and waste treatment activities, went through. In August, the acquisition of the operating subsidiaries of Europe Services Groupe (ESG) in France was completed. The company operates in two of the most populated regions of the country (Ile-de-France and Rhône-Alpes), across several lines of business, including waste collection and street cleaning.

As regards the new contracts awarded in Spain, as part of the organic growth of the business, the following are worth particular mention:

- Renewal of the MSW, street cleaning and sewerage contract in Hospitalet worth 396 million euros, for a period of 10 years, during which a complete overhaul of the service fleet will be undertaken, employing dynamic formulas for activity levels and assets under coverage.

- Renewal and modernisation of the street cleaning system service in San Sebastián, with a backlog of 149.1 million euros over the next 10 years.

- New contract for waste collection, street cleaning and management of clean points in the city of Benalmádena, for a total of €82 million over the next 10 years.

- In relation to the Treatment business, the management of the Badajoz municipal solid waste (MSW) treatment plant (composting and recovery) for 15 years and an associated backlog amounting to €94.5 million.

In the USA:

- Sarasota County (Florida) awarded a new contract worth $750 million for MSW collection in the southern side of the county. The service will initially last for 7 years with two possible extensions of 7 and 6 years, respectively, which will begin in the first quarter of 2025. Staying in Florida, Clay County awarded the MSW collection service for a duration of 10 years plus two possible extensions of 5 years each. The total amount of the awarded portfolio, including extensions, amounts to $421 million.

- In May, in Saint Paul, Minnesota’s capital city, an MSW contract worth more than $115 million was awarded for a duration of seven years.

- In Buncombe County (North Carolina), the MSW collection contract is worth more than $100 million, lasting for an initial duration of seven years with a possible one-year extension.

These contracts entail increasing the population served in Florida by 780,000 people, in Minnesota by 300,000 and a further 175,000 in North Carolina, taking the population served globally by the Environment Area to almost 71 million people. In several cases, the services will be provided by new vehicles that run on compressed natural gas, as well as other fully electric vehicles, thus demonstrating FCC’s commitment to sustainability and the urban environment.

FCC Aqualia expands its international activity and consolidates its leadership position in Spain

FCC Aqualia increased its position in France with a variety of awards and extensions in towns and communities (Pithiverais-Gatinais, Goussainville, Thillay, Vaudherland, Andrésy, Chanteloup les Vignes, Conflans-Sainte Honorine, Ecquevilly and Triel sur Seine). When combined, the contracts provide over €88 million in backlog revenue. These awards are in addition to supply contract renewals achieved in previous periods that increase Aqualia's presence in France, where it already provides services to one million residents.

In Spain, the renovation of the supply and sewerage service in Mazarrón for a period of 15 years is worth particular mention. The contract is worth 133.7 million euros.

FCC Construction Australia will build the largest social housing complex in Queensland

FCC Construction Australia has been selected to build and deliver 490 social housing units in South Cairns, the largest affordable housing development in Queensland, Australia. The project is supported by the Queensland Government's A$2 billion Housing Investment Fund, an initiative that aims to support a total of 5,600 social housing units to be built across the state.

Elsewhere, the consortium headed up by FCC Construcción (60%) was chosen to build the new Oporto metro line, known as Rubi (H), for an attributable amount of €227.7 million. The new line will add 6.3 kilometres to the city’s existing metro network. The joint venture in Spain in which FCC Construction holds an interest was awarded the contract for the underground construction of line R2 in Montcada i Reixac (Barcelona), as well as the construction of the new station in this town, for an attributable amount of €148.9 million.

In industry, two awards are worth particular mention; firstly, a consortium in which the company holds a 30% stake, received a backlog of more than €260 million for the construction of a storage and regasification plant in Stade (Germany); in addition, the consortium formed by FCC Industrial (28% holding), was awarded the roll out of the railway signalling and management service for the Murcia-Almería section of the Mediterranean Corridor in Spain, worth a total amount of €177 million.

It should be noted that in the second half of the year, the design and preliminary works phases for two important contracts were awarded (Fraser Tunnel in Canada and the Qiddiya stadium in Saudi Arabia), whose future construction would add a significant amount to the Area's revenue backlog.

FCC Concesiones expands its backlog and enhances its capital structure

In January 2024, FCC Concesiones was awarded Lot 8 of the Extraordinary Road Investment Plan for the Autonomous Region of Aragon. The concession contract has a term of 25 years with an initial investment of more than 40 million euros, with actions involving over 200 km of roads. The contract was signed in May and construction work began at the end of 2024.

In addition, in April, the acquisition, approved in December 2023, of all shares in the Parla Tram concession (Madrid), went through, with an operating deadline until 2045. The infrastructure spans 8.3 kilometres and 15 stations. This acquisition strengthens the position of FCC Concesiones in the high-capacity urban transport sector, adding to its tram operation in Murcia, Zaragoza and Barcelona.

Last December, the backlog and sources of financing were reorganised. As a result, capital was increased by more than €250 million, of which €102 million were allocated to the cancellation of bank debt, €52.1 million to the acquisition of intra-Group debt of the Murcia Tram and a further €49.1 million to financing the aforementioned road concession in Aragón.

The partial financial spin-off of FCC in favour of Inmocemento is now complete

On 16 May 2024, the Board of Directors of FCC S.A. announced the proposed partial financial spin-off of FCC, whereby it will transfer en bloc the Real Estate and Cement units to Inmocemento (a company wholly owned by FCC), without this entailing any extinction of the existing companies or units. More precisely, all the shares of FCYC, S.A. owned by FCC, representing 80.03% of its share capital, and the entirety of Cementos Portland Valderrivas, S.A. owned by FCC, representing 99.028% of its share capital, will be transferred. As a result, Inmocemento will acquire, by universal succession, all the assets, liabilities, rights, obligations and other items inherent to the spun-off assets. The proposal was approved by the General Shareholders' Meeting held on 27 June, with 99.9% of the votes of the attending capital voting in favour. The process was completed on 7 November, when the public deed for the spin-off was entered in the Companies Register and Inmocemento shares began trading on 12 November.

|

KEY FIGURES |

|||

|

(million euros) |

Dec. 24 |

Dec. 23 |

Chg. (%) |

|

Revenue |

9,071.4 |

8,217.3 |

10.4% |

|

Gross operating profit (EBITDA) |

1,435.3 |

1,285.2 |

11.7% |

|

EBITDA margin |

15.8% |

15.6% |

0.2 p.p |

|

Net operating profit (EBIT) |

725.4 |

725.9 |

-0.1% |

|

EBIT margin |

8.0% |

8.8% |

-0.8 p.p |

|

Income attributable to the parent company |

429.9 |

589.1 |

-27.0% |

|

Equity |

3,736.0 |

6,142.5 |

-39.2% |

|

Net financial debt |

2,990.4 |

3,100.1 |

-3.5% |

|

Backlog |

43,043.8 |

41,485.0 |

3.8% |

|

|

|

|

|